On June 27, 2016, the U.S. Supreme Court denied the plaintiffs’ petition for a writ of certiorari in Home Care Association of America v. Weil, leaving the U.S. Department of Labor’s (“DOL”) Home Care Rule intact. The Home Care Rule has extended minimum wage and overtime requirements to the vast majority of home care workers by eliminating the availability to third-party agencies of the companionship and live-in domestic service worker exemptions and by dramatically narrowing the definition of companionship services.

At the outset, it appeared that the DOL’s Home Care Rule would not survive judicial scrutiny, when the U.S. District Court for the District of Columbia vacated both major provisions of the Rule – the third-party exclusion on December 22, 2014 and the companionship services definition on January 14, 2015. However, the DOL appealed these decisions, and on August 21, 2015, the U.S. Court of Appeals for the District of Columbia Circuit (“D.C. Circuit”) upheld the Home Care Rule and reversed the district court’s decisions vacating the major provisions of the Rule. After the district court entered summary judgment in favor of the DOL on October 20, 2015, the Home Care Rule went into effect. The plaintiffs sought review by the Supreme Court of the D.C. Circuit’s decision, which has just been denied.

Spike in Litigation

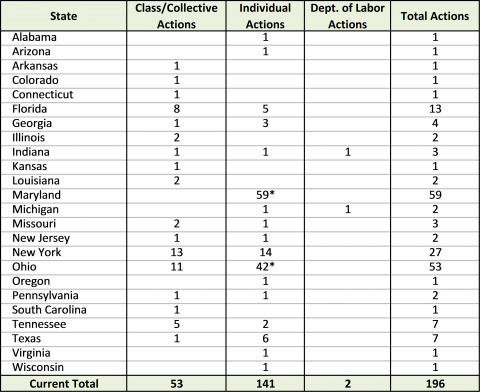

Since the Home Care Rule went into effect, the number of wage and hour lawsuits against home care companies has increased dramatically. Below is snapshot of the breadth lawsuits alleging violations of the FLSA against home care and home health care entities that have been filed in federal court. While not separately tracked, the state court filings are typically more than double the federal court actions, meaning more than 600 separate wage hour lawsuits have been filed against home care companies in the last eight months. States such as California, New York, and Colorado have been fertile ground for lawsuits alleging violations of state wage hour laws. These lawsuits often concern the compensability of sleeping time, meal time, and/or travel time.

SNAPSHOT: Federal Court Actions Alleging FLSA Violations Related to Home Care and Home Health Care from October 1, 2015 to June 24, 2016

*Note: The Maryland single-plaintiff filings and 40 of the Ohio single-plaintiff filings arise from the decertification of a large class case.

DOL Issues Guide to Consumers and Home Care Workers Discussing the Home Care Rule

In addition to the risk of private suit, the home care industry faces increased attention from the DOL. In late March, the agency issued “A Guide for Consumers and their Families to the Fair Labor Standards Act,” (the “Guide”) which purports to educate private household consumers, their families, and home care workers on the federal wage and hour requirements that now apply to home care workers.

The Guide instructs consumers that they may be considered the employer of a home care worker: “If you hired the home care worker directly, and no agency or other organization is involved, then you are an employer.” This guidance, while oversimplifying the “economic realities” test used to determine whether an individual or entity is the employer of another, nonetheless illustrates the DOL’s very broad position on the employment status of home care workers. Furthermore, the DOL reiterates that, given the narrowing of the definition of companionship services, even an individual consumer is likely responsible for the payment of minimum wage or overtime: “If you use or manage the services of a home care worker, you may be responsible for paying minimum wage and overtime, and for keeping certain records regarding your home care worker(s).” Accordingly, the companionship exemption is rarely a safe harbor, even for the individual consumer.

The Guide also discusses the likelihood that a consumer is the joint employer of a home care worker provided by a home care agency: “If you hired the home care worker through an agency, you are probably an employer of that worker. Under the FLSA, an employee can have more than one employer — in this case, both the agency and you.” This is particularly significant for home care companies that have relationships with independent contractor caregivers, such as nurse registries who refer such workers to individual consumers. The DOL’s Wage & Hour Division (“WHD”) recently issued an Administrator’s Interpretation (“AI”) that sets forth new standards for determining joint employment under the FLSA (and the Migrant and Seasonal Agriculture Worker Protection Act). While it is not yet clear how much deference will be accorded to the sub-regulatory guidance, the WHD may use the AI to cast a wider net and argue that the entities that associate with independent contractors are joint employers with the consumer and/or other entities. The WHD’s motivation is clear — to expand statutory coverage of the FLSA to small employers and collect back wages from larger employers:

Where joint employment exists, one employer may also be larger and more established, with a greater ability to implement policy or systemic changes to ensure compliance. Thus, WHD may consider joint employment to achieve statutory coverage, financial recovery, and future compliance, and to hold all responsible parties accountable for their legal obligations.

To determine whether horizontal joint employment exists, the WHD will apply its current joint employment regulations and examine the following non-inclusive factors:

- who owns the potential joint employers (i.e., does one employer own part or all of the other or do they have any common owners);

- do the potential joint employers have any overlapping officers, directors, executives, or managers;

- do the potential joint employers share control over operations (e.g., hiring, firing, payroll, advertising, overhead costs);

- are the potential joint employers’ operations inter-mingled (for example, is there one administrative operation for both employers, or does the same person schedule and pay the employees regardless of which employer they fwork for);

- does one potential joint employer supervise the work of the other;

- do the potential joint employers share supervisory authority for the employee;

- do the potential joint employers treat the employees as a pool of employees available to both of them;

- do the potential joint employers share clients or customers; and

- are there any agreements between the potential joint employers.

However, with respect to vertical joint employment (e.g., an “employer” household consumer and an intermediary entity such as a nurse registry), the AI announces that it will abandon the current FLSA joint employment regulations. Instead, the DOL will apply the “economic realities” test in evaluating the relationship between or among the entities at issue. In the context of the home care industry, the DOL may deem an individual consumer the “small employer” to expand statutory coverage to a “large employer,” like a nurse registry that refers home care workers to such consumers.

Accordingly, in this context, companies that have relationships with independent contractors should review their practices through the lens of the “economic realities” test. When applying the economic realities test to determine vertical joint employment, the WHD will draw from the seven economic reality factors describe in the MSPA regulations (which do not, as a legal matter, apply to the FLSA):

A. Directing, Controlling, or Supervising the Work Performed. To the extent that the work performed by the employee is controlled or supervised by the potential joint employer beyond a reasonable degree of contract performance oversight, such control suggests that the employee is economically dependent on the potential joint employer. The potential joint employer’s control can be indirect (for example, exercised through the intermediary employer) and still be sufficient to indicate economic dependence by the employee. See Torres-Lopez, 111 F.3d at 643 (“indirect control as well as direct control can demonstrate a joint employment relationship”) (citing pre-1997 MSPA regulation); Antenor, 88 F.3d at 932, 934; 29 C.F.R. 500.20(h)(5)(iv). Additionally, the potential joint employer need not exercise more control than, or the same control as, the intermediary employer to exercise sufficient control to indicate economic dependence by the employee.

B. Controlling Employment Conditions. To the extent that the potential joint employer has the power to hire or fire the employee, modify employment conditions, or determine the rate or method of pay, such control indicates that the employee is economically dependent on the potential joint employer. Again, the potential joint employer may exercise such control indirectly and need not exclusively exercise such control for there to be an indication of joint employment.

C. Permanency and Duration of Relationship. An indefinite, permanent, full-time, or long-term relationship by the employee with the potential joint employer suggests economic dependence. This factor should be considered in the context of the particular industry at issue. For example, if the work in the industry is by its nature seasonal, intermittent, or part-time, such industry condition should be considered when analyzing the permanency and duration of the employee’s relationship with the potential joint employer.

D. Repetitive and Rote Nature of Work. To the extent that the employee’s work for the potential joint employer is repetitive and rote, is relatively unskilled, and/or requires little or no training, those facts indicate that the employee is likely economically dependent on the potential joint employer.

E. Integral to Business. If the employee’s work is an integral part of the potential joint employer’s business, that fact indicates that the employee is likely economically dependent on the potential joint employer. Whether the work is integral to the employer’s business has long been a hallmark of determining whether an employment relationship exists as a matter of economic reality. See, e.g., Rutherford Food Corp. v. McComb, 331 U.S. 722, 729-30 (1947).

F. Work Performed on Premises. The employee’s performance of the work on premises owned or controlled by the potential joint employer indicates that the employee is likely economically dependent on the potential joint employer. The potential joint employer’s leasing as opposed to owning the premises where the work is performed is immaterial because the potential joint employer, as the lessee, likely controls the premises.

G. Performing Administrative Functions Commonly Performed by Employers. To the extent that the potential joint employer performs administrative functions for the employee, such as handling payroll, providing workers’ compensation insurance, providing necessary facilities and safety equipment, housing, or transportation, or providing tools and materials required for the work, those facts indicate likely economic dependence by the employee on the potential joint employer.

DOL Issues Field Assistance Bulletin Discussing Compensability of Sleep Time

On April 25, 2016, the WHD published a Field Assistance Bulletin (“Bulletin”) discussing the exclusion of sleep time from hours worked by domestic service employees. In this discussion, it divided employees into three categories: (i) those who reside at the worksite (“live-in” employees); (ii) those who work shifts of 24 hours or more; and (iii) those who work shifts of less than 24 hours.

Live-In Employees

The WHD first reiterated the definition for a true live-in domestic service employee: an employee who resides at the private home in or about which he or she provides household services. The WHD then repeated its longstanding definition of a live-in employee as one who resides at his or her worksite: (i) on a “permanent basis,” i.e., stays there seven nights a week and has no other home; or (ii) for “extended periods of time,” i.e., works and sleeps there for five days a week (120 hours or more) or five consecutive days or nights (regardless of whether the total time is at least 120 hours).

For employees who meet this definition, employers may exclude sleep time from hours worked under the FLSA provided certain conditions are met: (1) the employer and employee have a reasonable agreement to exclude sleep time, and (2) the employer provides the employee “private quarters in a homelike environment.”

An employer of a live-in employee who resides at the home on a permanent basis may exclude up to eight hours of sleep time each night as long as the employee is paid for some other hours during the workweek. An employer of a live-in employee who resides at the home for extended periods of time may exclude from hours worked up to eight hours per night of sleep time as long as the employee is paid for at least eight hours during the relevant 24-hour period.

Reasonable Agreement

The Bulletin explains that the reasonable agreement cannot be a unilateral decision by the employer and should be in writing. With regard to sleep time, it indicates that “the reasonable agreement should reflect the realities of the particular situation; sleep time may only reasonably be excluded, for example, if a home care employee regularly has the opportunity to sleep overnight, rather than if the employee is present to actively provide around-the-clock care.”

Private Quarters in a Homelike Environment

The Bulletin clarifies that, although “in most cases,” private quarters means a separate bedroom, this is not a bright-line rule and the WHD will consider the particular circumstances of the case. It provides the following example: “if a home care worker provides live-in services to an individual who does not have a residence with enough space to give the worker her own bedroom but the home is arranged in a manner designed to give the employee as much privacy as reasonably possible, that arrangement could fulfill this requirement.” It elaborates that: (i) “[t]his space must be furnished with, at minimum, a bed, lighting, and a dresser and/or closet in which to store clothing and other belongings;” and (ii) “[t]he employee must be able to leave her belongings in this room during on-duty and off-duty periods.” The private quarters will be considered to be in a “homelike environment” when the space includes facilities for cooking and eating, a bathroom, and a space for recreation, whether shared by the provider and consumer and/or other household members.

Shifts of 24 Hours or More

For those employees who do not qualify as live-in employees but are on duty for 24 hours or more, sleep time of up to eight hours may be excluded from hours worked when (1) the employee is provided with “adequate sleeping facilities,” (2) he or she “can usually enjoy an uninterrupted night’s sleep,” and (3) the parties have an “expressed or implied agreement” to exclude the sleep time.

Adequate Sleeping Facilities

To exclude sleep time for employees who are on duty for 24 hours or more, the employee need only have access to “adequate sleeping facilities,” meaning access to basic sleeping amenities, such as a bed and linens; reasonable standards of comfort; and basic bathroom and kitchen facilities, which may be shared. Unlike for live-in employees, the sleeping area need not be private.

Usually Enjoy an Uninterrupted Night’s Sleep

The Bulletin clarifies the WHD’s enforcement position on whether an employee can “usually enjoy an uninterrupted night’s sleep,” as set forth in 29 C.F.R. § 785.22(a). WHD takes the position that five consecutive hours of sleep without interruption constitutes an “uninterrupted night’s sleep” and that an employee can “usually” enjoy that uninterrupted night’s sleep if he or she is getting that type of sleeping period at least half the time.

Section 785.22(b), on the other hand, addresses whether, on any particular night, the employee has gotten enough sleep to reasonably permit the exclusion of any portion of her regular sleeping period, assuming the requirements of Section 785.22(a) are met such that an employee’s sleep time is usually excluded from her hours worked. In that instance, the five hours need not be continuous, but interruptions must not be so frequent as to prevent reasonable periods of sleep that add up to at least five hours.

Express or Implied Agreement

The Bulletin reiterates the requirement that there must be an express or implied agreement, and that agreement may be evidenced by the parties’ conduct. However, the Bulletin counsels investigators to account for any evidence that the employee has objected to the exclusion of sleep time from her hours worked. As such, employers should have an agreement in writing and signed by the caregiver.

Shifts of Less than 24 Hours

Employees who work shifts of less than 24 hours must be paid for all hours worked during the shift, and no sleep time may be excluded even if the worker sleeps during the shift.

For Both Live-In Employees and Employees on Duty for 24 Hours or More

The Bulletin also notes that two additional limitations are applicable to both live-in employees and employees who are on duty for 24 hour or more: (i) any interruption of what might otherwise be properly excluded sleep time by a call to duty must be treated as hours worked; and (ii) if on a particular night the employee does not get reasonable periods of uninterrupted sleep totaling at least five hours, no sleep time may be excluded.

Conclusion

The DOL’s Home Care Rule appears to be here to stay. Given the increased risk of both litigation and the DOL’s increased scrutiny of the industry, home care companies should be vigilant in their efforts to comply with the FLSA’s minimum wage, overtime, and recordkeeping requirements. Moreover, companies that associate with independent contractor home care workers should conduct a thorough review of their practices and assess whether those workers are appropriately classified as independent contractors.